Free Carrier: Learn the Responsibilities, Advantages, and Disadvantages of Using an FCA Shipping Agreement

Table of Contents

What does FCA Mean in shipping terms?

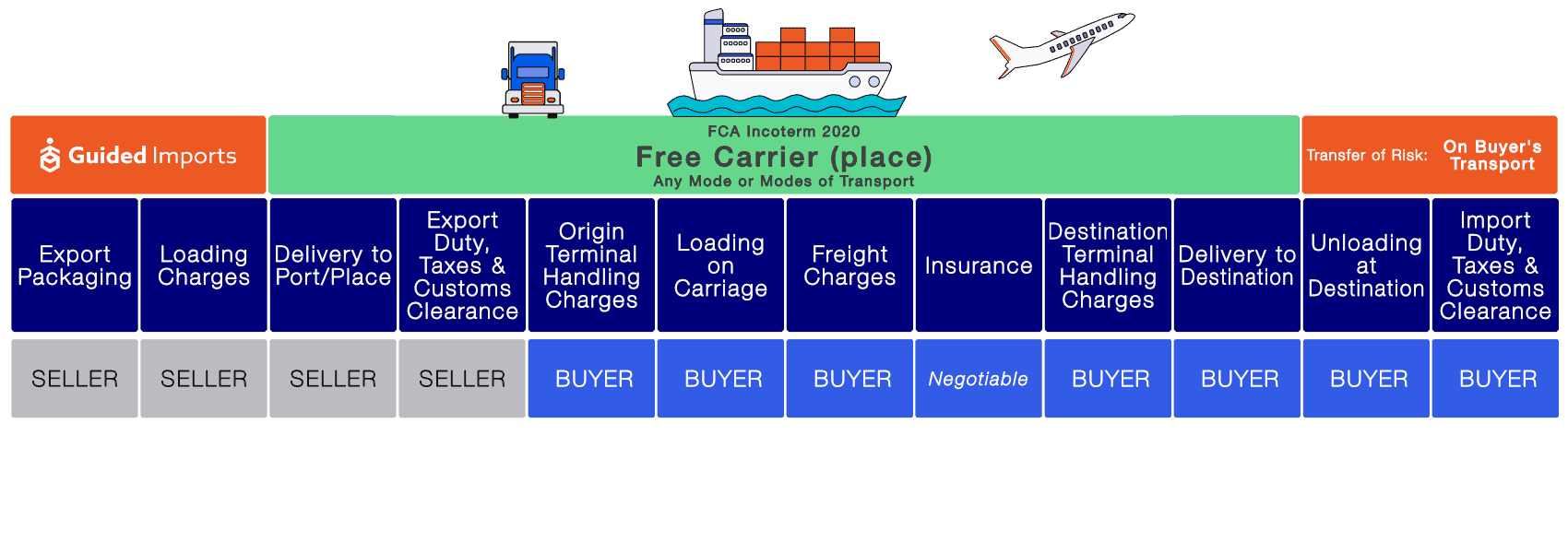

The FCA Incoterm is an agreement that means “Free Carrier,” where the seller’s obligations are to deliver the cargo to an agreed-upon port, known as the “Named Place.” The seller is responsible for exporting the shipment, and all steps before that. The buyer assumes the responsibility for the cargo once they are ready to be loaded onto the carrier.

FCA can be used for any form of transport, such as air freight, sea freight, road freight, and rail freight. This Incoterm provides the buyer with flexibility, as they can arrange carriage, frequently at a better price than what their seller might quote. While the buyer assumes all risks and responsibilities once the goods reach the point of export, FCA enables the buyer to step take over after the cargo has been exported, which can be a risky and tedious process for some products.

What are the Buyers and Sellers Responsibilities with FCA Agreements?

Let’s explore the buyer’s and seller’s responsibilities under an FCA agreement.

Sellers Responsibilities

Under FCA Incoterms, the seller must handle the full export process for the products they are selling. Once the cargo is ready to be loaded on to the vessel, responsibility transfers to the buyer. Below, we have listed the full responsibilities of the seller.

- Export Packaging: The cargo must be packaged for export. Some countries have unique requirements for how products must be exported. This can include specific markings on the packaging, or types of packaging. The party responsible for this aspect must ensure the packaging is in accordance with export regulations.

- Loading Charges: As the cargo leaves the sellers location, these are any costs associated with loading the cargo onto the first carrier to transport the goods to the export location.

- Delivery to Port/Place: Once the cargo loads onto the truck, these are the charges associated with transporting the goods from the seller’s location to the defined port or place where the cargo will be exported. In most instances, the port or place would be a seaport, airport, or rail port.

- Export Duty, Taxes, & Customs Clearance: The costs and responsibilities associated with formally exporting the cargo from the origin country. This could include customs examinations, pre-shipment inspection, or any special clearance required to export the cargo.

The above responsibilities entirely fall on the seller, when trading under the FCA Incoterm. It would be considered a breach of the purchase agreement if a seller were to request compensation from any of the above responsibilities. When a seller is quoting a price to the buyer, the fee will include the costs for the seller to fulfill the above duties.

Once these responsibilities have been met, the cargo can be transferred to the buyer. All risks associated with the following steps of the logistics process will fall upon the buyer.

Buyers Responsibilities

When the cargo clears customs and arrives at the Named Place, the risk transfers to the buyer, below are the responsibilities the buyer must fulfill to conclude the logistics process.

- Origin Terminal Charges: Any costs or requirements associated with the shipping terminal where the cargo loads onto the designated vessel for the main portion of the transportation process.

- Loading on Carriage: For the cargo to be loaded onto the carriage, a loading charge required by the shipping line.

- Carriage Charges: This is the freight charge when moving the cargo from the port of origin to the port of destination.

- Insurance: While insurance is not an obligation, it becomes the buyer’s responsibility to determine if they would like to obtain an insurance policy.

- Destination Terminal Charges: Once the cargo has arrived at the port of destination, any terminal charges associated with unloading, transferring, and holding the load as it awaits the formal import process.

- Delivery to Destination: Transporting the cargo from the port of destination to the buyer’s requested delivery destination.

- Unloading at Destination: Any costs associated with unloading the cargo at the buyer’s requested delivery destination.

- Import Duty, Taxes & Customs Clearance: The costs and responsibilities associated with importing the goods fall on the buyer. In the event of any examinations, duty, taxes, or other requests made by customs authorities must be fulfilled or compensated by the buyer.

Advantages and Disadvantages for the Buyer

Advantages

International traders and shipping companies like to explain that EXW is the worst Incoterm for a buyer, as all risk falls on them. With FCA, the buyer regains some control as the seller is responsible for the export formalities. When comparing FCA and EXW, FCA is much more advantageous.

FCA allows a buyer to have ultimate control over the transportation of their products after the cargo has been formally exported from the country of origin. Some buyers feel that they can take advantage of this Incoterm because of the ability to control all moving pieces of the logistics process.

When buyers routinely purchase containerized goods, and they have an established 3rd party logistics company or freight forwarder they can rely on, FCA can be an advantageous Incoterm. With FCA, the buyer controls all costs associated with the logistics process after the formal export. This means that they can rely on their shipping service provider to find the best price and solution for the cargo from the port of origin to the final destination.

Buyers will opt to use the FCA Incoterm when they are confident that their shipping service provider can beat the loading costs offered by the seller.

Disadvantages

There is a reason FCA is not as common as FOB for ocean shipments. FCA requires additional steps at the port of origin for the buyer to step in, which makes the buyer responsible for terminal and loading costs. While these costs are not problematic for the buyer to pay, the inefficiency arises in the event of a problem. Anytime there is an issue during the shipping process, the best party to resolve the issue is dependent on if the cargo is in the seller’s country or the buyer’s country.

The International Chamber of Commerce only recommends this Incoterm to be used with containerized shipments, and there is a reason why they suggest this. In most containerized shipment transactions, the container will move from the seller’s warehouse to the terminal. In this event, the Named Place is the terminal, and thus the transfer of risk takes place after the cargo goes through the export formalities. However, in the event, FCA is a quoted Incoterm, and the buyer requests the cargo be shipped to a Named Place other than the port, such as a forwarders warehouse, the transfer of risk occurs once the truck arrives at the destination. In this event, the buyer would be required to cover the costs to unload the shipment at their forwarders warehouse, while also being responsible for the export formalities, terminal, and carriage loading charges.

If you are shipping under FCA, but not moving the cargo directly from the factory to the vessel, there is very little difference between FCA and EXW.

In certain countries, such as China, FCA goes against the status quo. For buyers who are adamant on purchasing under FCA terms, most sellers will agree, however, the notable trend is for Chinese sellers to quote under FOB terms. So while FCA is not incredibly different, the disadvantage of using it can be that sellers are not as familiar with the process. When exporting products from any country, the best Incoterm is frequently where both the buyer and seller have the most experience.

When to Use an FCA Agreement?

The only time a buyer would want to consider FCA is if most of the following parameters can be met:

- The cargo they are shipping is containerized

- They have existing knowledge of the logistics process and requirements in the sellers country, or they are using a shipping service

- Their seller equally prefers FCA over FAS or FOB.

- The cargo is being transported directly to the terminal for export, and not to the shipping service provider’s warehouse.

If the above four conditions can be met, FCA is a viable option to consider as an Incoterm.

FCA Agreements for China Importing: are they a good idea?

In general, unless you fall into the category above, the FCA agreement is not the most ideal agreement to use when importing from China. China is a unique country where factories export so much and are capable of doing it rather efficiently because they primarily rely on one major Incoterm, which is FOB. So unless there is a legitimate reason why FOB is not ideal for your shipment, it is best to stick with what works, and not slow down or confuse things by testing out other terms.

If you are an importer looking to try FCA for your next China shipment, this is what we can recommend. First, ask your factory if they are comfortable with quoting FCA. Second, reach out to your China freight forwarder, or a China 3rd party logistics company company so you can have them help you compare FCA with FOB.

And no matter which incoterm you ultimately decide to use, China freight insurance is always a wise investment, as it’s a small price to pay to avoid catastrophic loss or supply chain disruption.

EXW Agreement FAQ’s

Who pays freight with an FCA incoterm agreement?

Under the Free Carrier, or FCA Incoterm, the buyer is responsible for all freight costs.

What is the difference between FCA and FOB?

FCA is an Incoterm which works for all modes of transport. FOB is only used in waterway shipments. Under FOB, the seller is responsible for loading the cargo onto the vessel, but with FCA, it is the buyer’s responsibility. FCA transfer risk takes place at an agreed-upon point, whereas with FOB, the buyer assumes the risk on the vessel.

Does FCA include customs clearance?

Under FCA Incoterms, the seller is responsible for export duty, taxes & customs clearance, and the buyer is responsible for import duty, taxes & customs clearance.