What does DAP Mean in shipping terms?

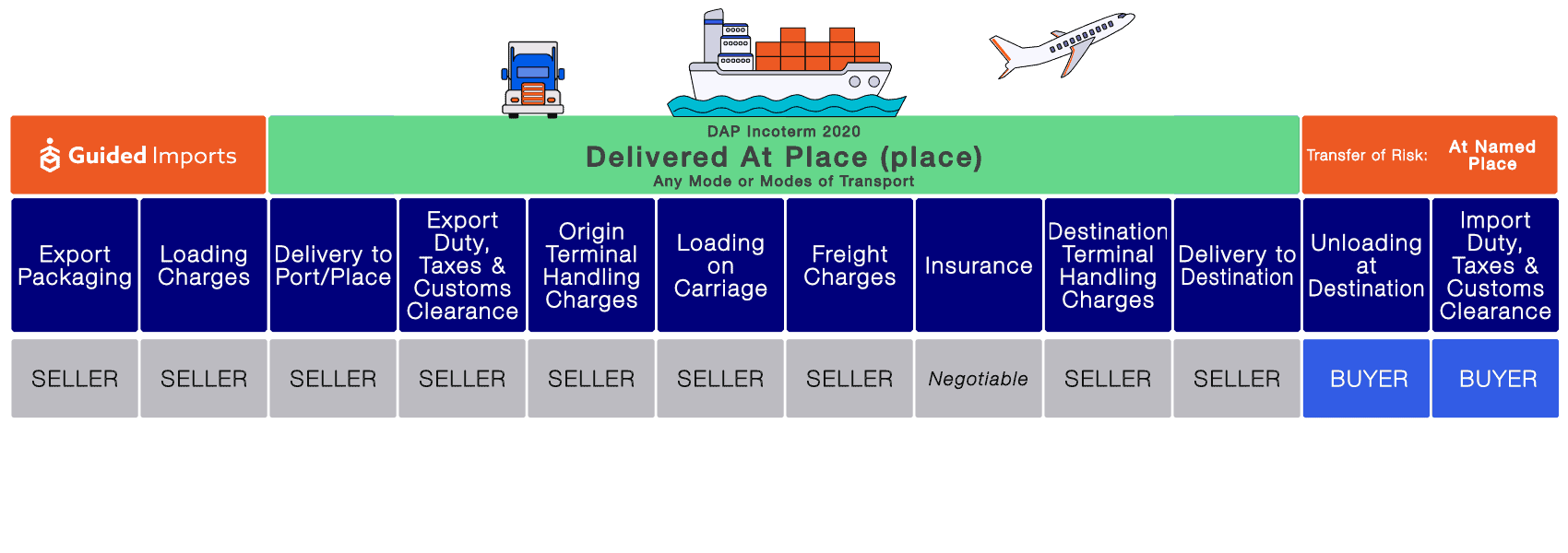

DAP is a Shipping Incoterm that means “Delivered at Place,” where the seller is responsible for all costs and risks associated with the delivery of the goods to the final agreed-upon place, usually the buyer’s premises. DAP works for sea freight, air freight, road freight, and rail freight, the buyer is only responsible for importing and unloading the cargo.

Buyers need to understand DAP does not mean there will be no additional charges outside of the DAP product cost. The only other fees the buyer needs to factor in are freight insurance, import taxes, customs brokerage, and any expenses incurred to unload the cargo from the container at the final destination.

DAP has since replaced the similar Incoterms, DAF, DES, and DDU, which were retired in previous decades.

What are the Buyers and Sellers Responsibilities with DAP Agreements?

Let’s explore the buyer’s and sellers’ responsibilities under a DAP agreement.

Sellers Responsibilities

- Export Packaging: Preparing the cargo so it can be exported.

- Loading Charges: Any costs associated with loading the cargo onto the truck at the seller’s warehouse.

- Delivery to Port/Place: The trucking or delivery fees associated with transporting the cargo to port or place of export.

- Export Duty, Taxes & Customs Clearance: All costs and responsibilities associated with exporting the cargo.

- Origin Terminal Handling Charges: Also known as OTHC, the seller is responsible for these charges.

- Loading on Carriage: The seller must cover all costs to load the cargo onto the carriage.

- Freight Charges: The shipping cost to transport the cargo to the buyer’s destination.

- Destination Terminal Handling Charges: Also known as DTHC, the seller is responsible for these charges.

- Delivery to Destination: Once the cargo arrives at the buyer’s destination port, the seller is responsible for the final journey to truck the load to the final destination.

Buyers Responsibilities

- Unloading at Destination: The buyer is responsible for any costs associated with unloading the cargo once it arrives via truck to their final destination, usually a warehouse.

- Import Duty, Taxes & Customs Clearance: The buyer is responsible for all importation costs associated with the shipment. In the event a customs examination is required, the buyer is responsible for the exam’s costs.

Advantages and Disadvantages for the Buyer

Advantages:

A significant advantage for the buyer when shipping under DAP Incoterms is understanding which party is responsible for paying any additional expenses during the shipping process. The International Commerce Center (ICC) indicates the buyer is responsible for all risks and losses associated with the cargo once the goods have been made available to them. In most instances, the load would be made available to them at the buyer’s warehouse. In the event of any additional costs during the shipping process, the seller bears the responsibility.

Due to this decreased buyer’s risk, DAP offers a minimal liability option and a widespread agreement for buyers wishing to place all shipping risk on the seller.

DAP can help buyers manage cash flow and inventory, especially for expensive items that require routine reordering from sellers. When appropriately negotiated with sellers, buyers can negotiate DAP Incoterms, where the seller fulfills the shipping, and the buyer only needs to pay once the cargo arrives at their destination. When products are routinely reordered, or specific quantities are guaranteed, a seller can ship it to a bonded warehouse close to the buyer’s destination. Whenever the buyer is ready to reorder, the cargo would be sent from the local bonded warehouse.

This has a massive benefit for the buyer. It allows them to order lower quantities and have them fulfilled more efficiently, as opposed to waiting for the cargo to arrive from the seller’s origin.

Disadvantages:

While the buyer’s requirements to cover all import duty, taxes, and customs clearance are well defined in this Incoterm, in practice, DAP can lead to delays. In most cases, customs clearance happens before the cargo arrives at the buyer’s designated destination, which means customs must allow the shipment to pass before it is delivered to the buyer. In the event of delays, dunnage, or detention, these costs will be incurred at the buyer’s expense.

Like all Incoterms where the seller both bears the risk and responsibility to ship the cargo, the overall cost will be significantly higher than if a buyer were to rely on their China 3rd party logistics or China freight forwarder.

There are known disadvantages for the seller, and DAP can be considered a risk for some sellers, especially when shipping under these terms to new buyers. Because one of the most significant risks a seller faces is that the buyer could refuse to pay import duties, the seller has a considerable risk of losing their cargo. Sellers are well aware of these risks and will either mitigate the risks with increased deposits or higher fees to make the shipping process worthwhile.

When to Use a DAP Agreement?

One of the most significant aspects of the DAP agreement is that it offers many options that can be hugely beneficial to both the buyer and seller. Because of this, anytime a seller is open to the agreement, it is an Incoterm that is work considering.

DAP can minimize the risks and obligations for newer importers, but they should be prepared to pay a steep price. If you are a less experienced importer, and a seller offers DAP Incoterms, be sure to compare the rates with FOB and CIF Incoterms.

For more experienced importers looking for a solution to increase cash flow, DAP might be viable if your sellers are willing to consider the options. Some scenarios a buyer and seller could negotiate a DAP agreement are the following:

- If the named place is the buyer’s warehouse, DAP could mean that the buyer only needs to pay for the cargo once the goods arrive at their location. In this instance, the buyer would be paying for their products on the day they are received, and not tying up capital into inventory while being shipped.

- The seller could agree to ship more inventory to a warehouse local to the customer, usually a bonded warehouse, and then the customer could purchase the products from the seller at any time. The buyer would only need to pay for the import fees and unloading costs.

- If the buyer is purchasing products imported into multiple countries, DAP can offer a creative solution that could minimize the freight charges. For example, if products were to be bought from China and shipped to the United States and Canada, the cargo could share a single container, sent to a port close to each country, such as in Seattle, Washington. The buyer would request the named place be a bonded warehouse. Once the cargo arrives, it would be deconsolidated, and part of the shipment imported in the United States, and the other part of the consignment transshipped into Canada.

- While this scenario is unique, it illustrates how DAP can offer buyers creative solutions to manage their logistics with their sellers.

Anytime a buyer agrees to a DAP trade, they must communicate with their sellers. The point of destination should be made well defined, and an agreed-upon timeline is essential to ensure that the seller makes an effort to prevent delays. It is good to arrange a pre-shipment China quality inspection before the cargo leaves the seller, so the buyer can find out if there are any problems before it is too late.

Buyers and sellers should also communicate which party is responsible for any dunnage, detention, or storage fees arising from unforeseen risks during the exporting and importing process.